As Prime Minister Narendra Modi goes around Bihar addressing up to four rallies a day in the run-up to the next phase of polling in the ongoing assembly elections, hundreds of delegates from 54 African countries have descended upon New Delhi to discuss trade and diplomatic ties with India. The African continent is witnessing rapid growth in some regions even as large parts of its population remain afflicted with low development indicators, something that India still grapples with.

The India-Africa summit, hence, is touted to be the biggest and most important step in establishing concrete ties with Africa and boosting trade even further. Heads of government, policy makers and experts from all the 54 African countries are participating in the summit between October 26-30 in New Delhi to discuss enhanced political and economic interaction.

While India and Africa have been trade partners for a long time and in the contemporary world, a tenth of India’s all exports go to Africa, the trade hasn’t actually become as substantial as it was once hoped. In 2013, the government of India set itself up a “modest” target by claiming that it expects total value of trade with Africa to rise to $100 billion by 2015.

“We will hopefully be reaching the trade target of $100 billion by 2015," commerce and industry minister Anand Sharma had said in Johannesburg. "It is a modest target."

Even though the trade has risen manifold over the past decade, it still stands closer to $70 billion, far short of the promised $100 billion, it is expected that agreements signed and commitments made during the summit will provide new avenues and make African nations an important destination for India’s exports.

As is clear from the above chart, total trade between India and Africa has more than doubled in just six years. It jumped from $30 billion in 2009 to $70 billion in 2015, according to the data by International Monetary Fund. However, this is less than 10% of India’s total trade with the world which is estimated to be around $758 billion.

India has overtaken the United States in being the biggest buyer for Nigerian oil, which has made the country India’s foremost trade partner in the region. Nigeria is followed by South Africa, Egypt and Angola if value of trade with India is considered.

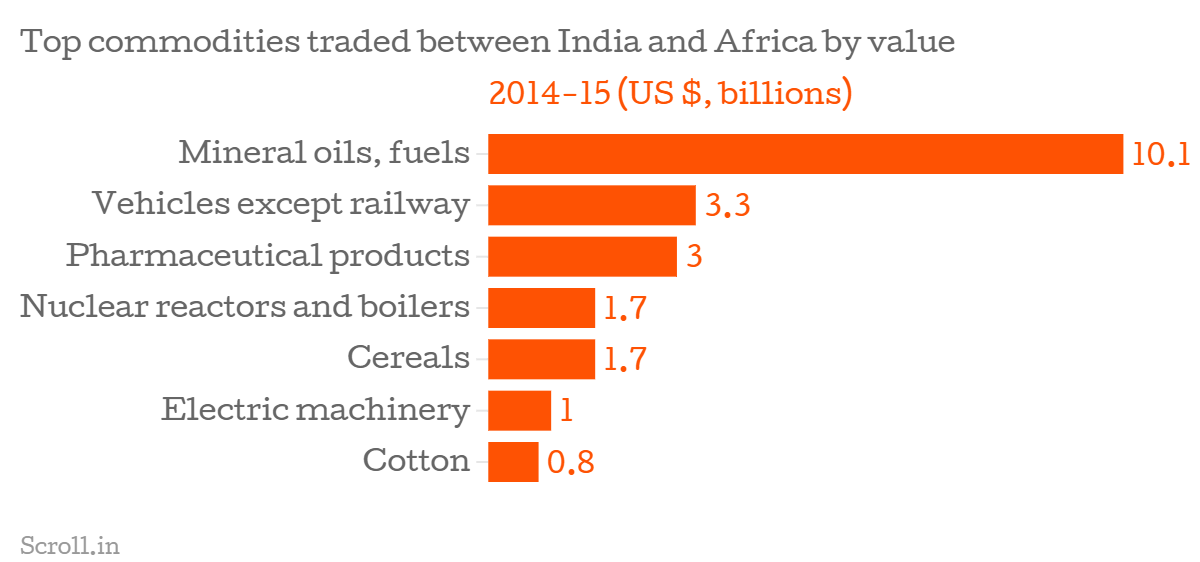

Indian policymakers are also expected to find markets in African countries for Indian goods. The chart above shows most traded commodities between India and Africa in 2014-15.

Over the last two years, trade in ship building parts, railway goods, and wood products more than doubled between India-Africa while trade of silk, dairy products, arms and ammunition and aircrafts declined anywhere between 50%-99%.

While India grapples to boost trade of items other than oil with Nigeria, China is undertaking huge infrastructural projects which have established it as one of the major trade partners of the African continent, much ahead of India.

China’s exponential rise as a trade partner can be seen from the meteoric numbers of the total value of goods it exported to Africa. In 2009-10, China’s exports to the continent stood at $40 billion as compared to India’s $11.2 billion. These numbers swelled to $93.3 billion and $30 billion for China and India respectively in 2014-15, highlighting just how quickly the red dragon is flapping its wings in world’s second largest continent.

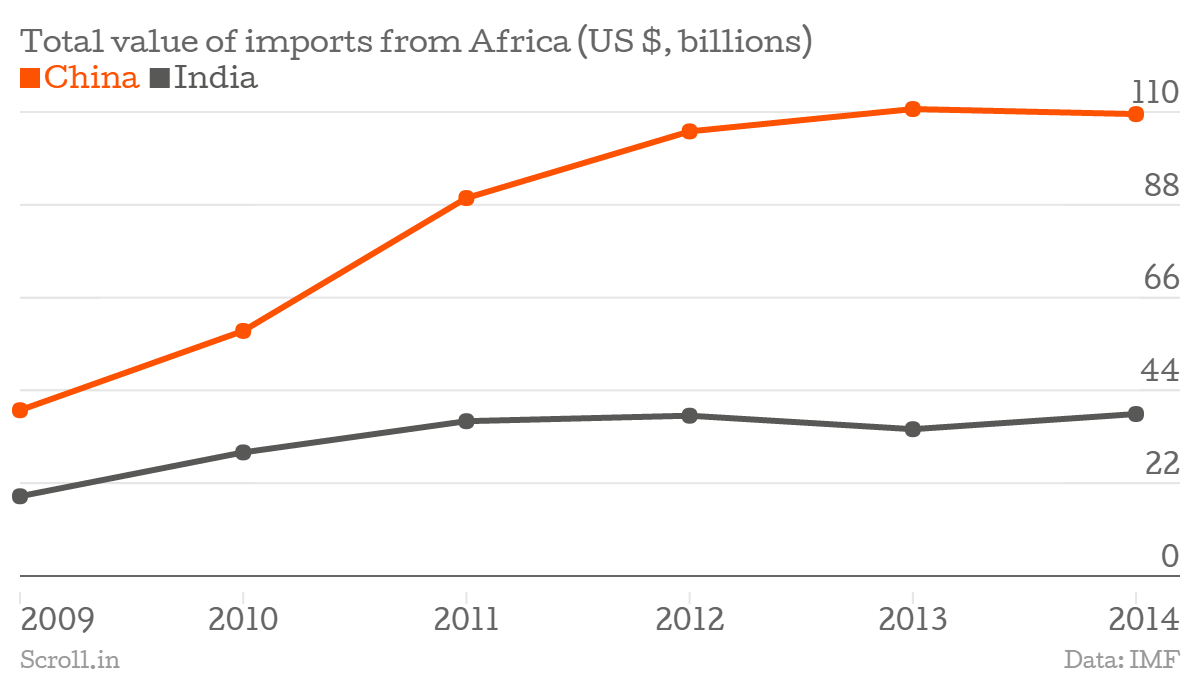

China’s imports too have gone from $39 billion in 2009 to over $109 billion in 2014-15 while India imported only $38.3 billion worth of goods from Africa last year.

As India tries to catch up with China’s dominance in trade with Africa, it has to diversify the basket of goods traded with African countries as over-dependence on certain commodities such as oil is leading to vast trade deficits with major trade partners in the continent.

A case in point is Nigeria, Africa’s largest country and India’s top trade partner by value. India’s imports from Nigeria constituted 99% of oil which drove its trade deficit with the country to a humongous $11 billion in 2014-15.

“India’s current stance toward Nigeria, despite the goodwill, seems thin and utilitarian,” Siddharth Mitter wrote on Scroll. “As an Indian diplomat in Abuja, Nigeria’s capital, recently explained, oil remains India’s perceived vital interest in the relationship. With Nigeria having displaced Saudi Arabia as India’s top oil supplier, the emphasis is likely to grow.”

The India-Africa summit, hence, is touted to be the biggest and most important step in establishing concrete ties with Africa and boosting trade even further. Heads of government, policy makers and experts from all the 54 African countries are participating in the summit between October 26-30 in New Delhi to discuss enhanced political and economic interaction.

While India and Africa have been trade partners for a long time and in the contemporary world, a tenth of India’s all exports go to Africa, the trade hasn’t actually become as substantial as it was once hoped. In 2013, the government of India set itself up a “modest” target by claiming that it expects total value of trade with Africa to rise to $100 billion by 2015.

“We will hopefully be reaching the trade target of $100 billion by 2015," commerce and industry minister Anand Sharma had said in Johannesburg. "It is a modest target."

Even though the trade has risen manifold over the past decade, it still stands closer to $70 billion, far short of the promised $100 billion, it is expected that agreements signed and commitments made during the summit will provide new avenues and make African nations an important destination for India’s exports.

As is clear from the above chart, total trade between India and Africa has more than doubled in just six years. It jumped from $30 billion in 2009 to $70 billion in 2015, according to the data by International Monetary Fund. However, this is less than 10% of India’s total trade with the world which is estimated to be around $758 billion.

India has overtaken the United States in being the biggest buyer for Nigerian oil, which has made the country India’s foremost trade partner in the region. Nigeria is followed by South Africa, Egypt and Angola if value of trade with India is considered.

Indian policymakers are also expected to find markets in African countries for Indian goods. The chart above shows most traded commodities between India and Africa in 2014-15.

Over the last two years, trade in ship building parts, railway goods, and wood products more than doubled between India-Africa while trade of silk, dairy products, arms and ammunition and aircrafts declined anywhere between 50%-99%.

While India grapples to boost trade of items other than oil with Nigeria, China is undertaking huge infrastructural projects which have established it as one of the major trade partners of the African continent, much ahead of India.

China’s exponential rise as a trade partner can be seen from the meteoric numbers of the total value of goods it exported to Africa. In 2009-10, China’s exports to the continent stood at $40 billion as compared to India’s $11.2 billion. These numbers swelled to $93.3 billion and $30 billion for China and India respectively in 2014-15, highlighting just how quickly the red dragon is flapping its wings in world’s second largest continent.

China’s imports too have gone from $39 billion in 2009 to over $109 billion in 2014-15 while India imported only $38.3 billion worth of goods from Africa last year.

As India tries to catch up with China’s dominance in trade with Africa, it has to diversify the basket of goods traded with African countries as over-dependence on certain commodities such as oil is leading to vast trade deficits with major trade partners in the continent.

A case in point is Nigeria, Africa’s largest country and India’s top trade partner by value. India’s imports from Nigeria constituted 99% of oil which drove its trade deficit with the country to a humongous $11 billion in 2014-15.

“India’s current stance toward Nigeria, despite the goodwill, seems thin and utilitarian,” Siddharth Mitter wrote on Scroll. “As an Indian diplomat in Abuja, Nigeria’s capital, recently explained, oil remains India’s perceived vital interest in the relationship. With Nigeria having displaced Saudi Arabia as India’s top oil supplier, the emphasis is likely to grow.”

Buy an annual Scroll Membership to support independent journalism and get special benefits.

Our journalism is for everyone. But you can get special privileges by buying an annual Scroll Membership. Sign up today!